36+ Second home affordability calculator

Simply enter your monthly income expenses and expected interest rate to get your estimate. Our second home mortgage calculator uses a maximum debt-to-income ratio of 43 overall which is the maximum amount that many lenders will accept.

How To Build A Real Estate Website In 2022 Step By Step Guide

Provide details to calculate your affordability.

. With that magic number in mind you can. Your maximum monthly mortgage payment would. When it comes to calculating affordability your income debts and down payment are primary factors.

Total income before taxes for you and your household members. By using the 28 percent rule your mortgage payments should add up to no more than 19600 for the year which equals a monthly payment of 1633. 36 Second home affordability calculator Minggu 11 September 2022 Edit.

The amount of money you spend upfront to purchase a home. For example lets say your pre-tax monthly income is 5000. Payments you make for loans or other debt but not living expenses like.

These home affordability calculator results are based on your debt-to-income ratio DTI. Most home loans require a down payment of at least 3. You can find this by multiplying your income by 28 then dividing that by 100.

Your mortgage payment should be 28 or less. To calculate how much house can I afford a good rule of thumb is using the 2836 rule which states that you shouldnt spend more than 28 of your gross monthly income on home-related. Home affordability calculators use some basic information to determine your debt-to-income ratio.

A 20 down payment is ideal to lower your monthly payment avoid. Home affordability calculators use some basic information to determine your debt-to-income ratio. The proposed monthly mortgage payment of a home including taxes and insurance.

Whether youre buying your first home looking for a second property. Rent or mortgage for second home if needed Property maintenance Do not include. Your debt-to-income ratio DTI should be 36 or less.

How it Works. This calculator helps you estimate how much home you can afford. Your debt-to-income ratio DTI should be 36 or less.

The home affordability calculator will also estimate your annual homeowners insurance costs and property tax percentage and your actual costs may be higher. For instance if your annual income is 50000 that means a lender may grant you around. Adjust the loan terms to see.

Those who pay at least 20. Your housing expenses should be 29 or less. Generally lend between 3 to 45 times an individuals annual income.

For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. Mortgage lenders in the UK. With that magic number in mind you can.

You can update these for a.

3

How To Build A Real Estate Website In 2022 Step By Step Guide

Types Of Mortgage Refinancing Programs Refinance Mortgage Refinancing Mortgage Home Refinance

3

How To Build A Real Estate Website In 2022 Step By Step Guide

How To Build A Real Estate Website In 2022 Step By Step Guide

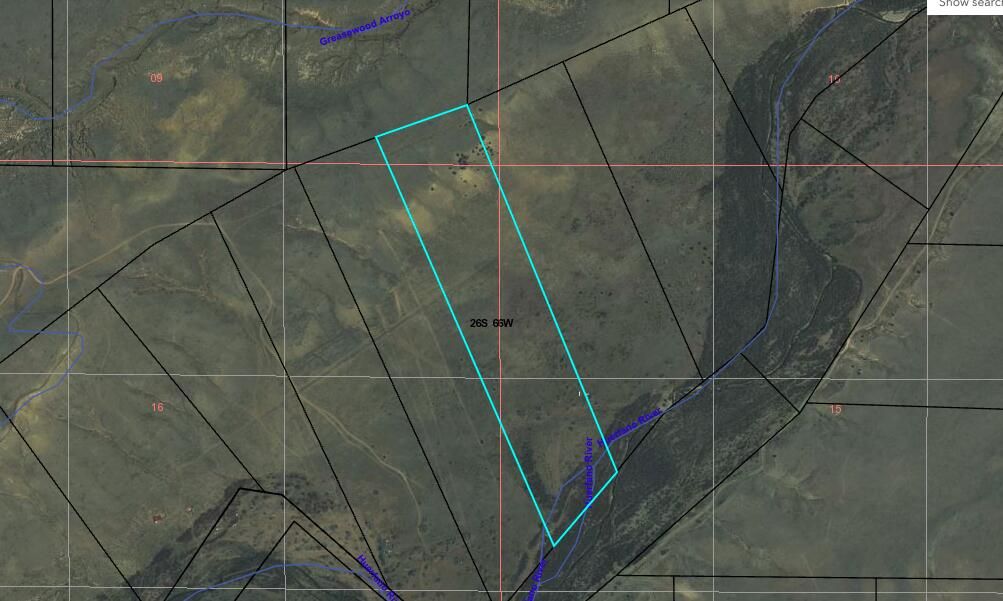

Colorado Land And Livestock 90 Walsenburg Co 81089 Mls 21 1154 Trulia

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Mortgage Amortization Calculator

Planning To Buy A House Spreadsheet Budgeting Worksheets Spreadsheet Business Buying First Home

3

1

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Compare The Mortgage Affordability For Toronto We Compare The Avarage Price Of The Home Price Increasing And Mortgage Best Mortgage Lenders Real Estate Fun

2

How To Build A Real Estate Website In 2022 Step By Step Guide

Homes On 5 Acres For Sale In Dayton Tx Zerodown

Mortgage Process 6 Easy Steps Easy Mortgage Process Steps So There You Have It 8 Simple Steps For Mor Mortgage Process Mortgage Quotes Refinance Mortgage